Morning and Evening Star Candlestick Patterns

In technical analysis, candlestick patterns offer insights into potential trend reversals. Two of the most reliable reversal patterns are the Morning Star and the Evening Star. These three-candle formations can often signal a strong shift in market sentiment — either from bearish to bullish or vice versa. In this guide, we’ll break down how these patterns form, what they mean, and how you can use them effectively in trading.

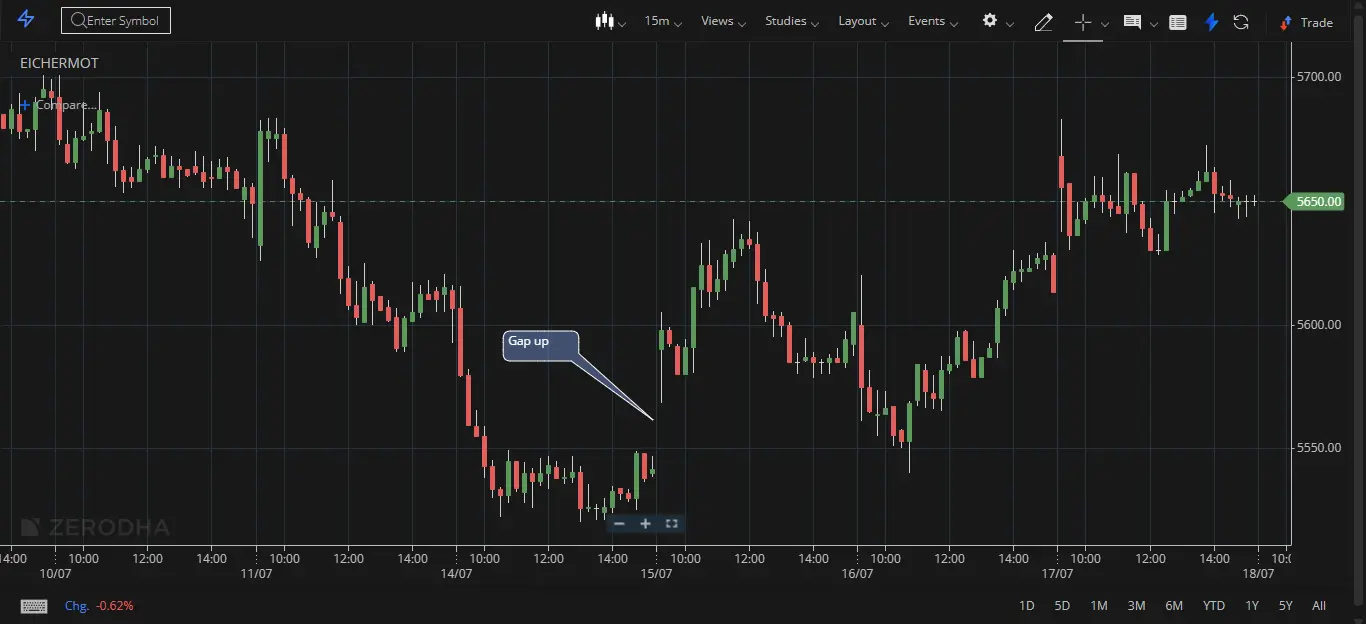

Illustration of gaps in market.

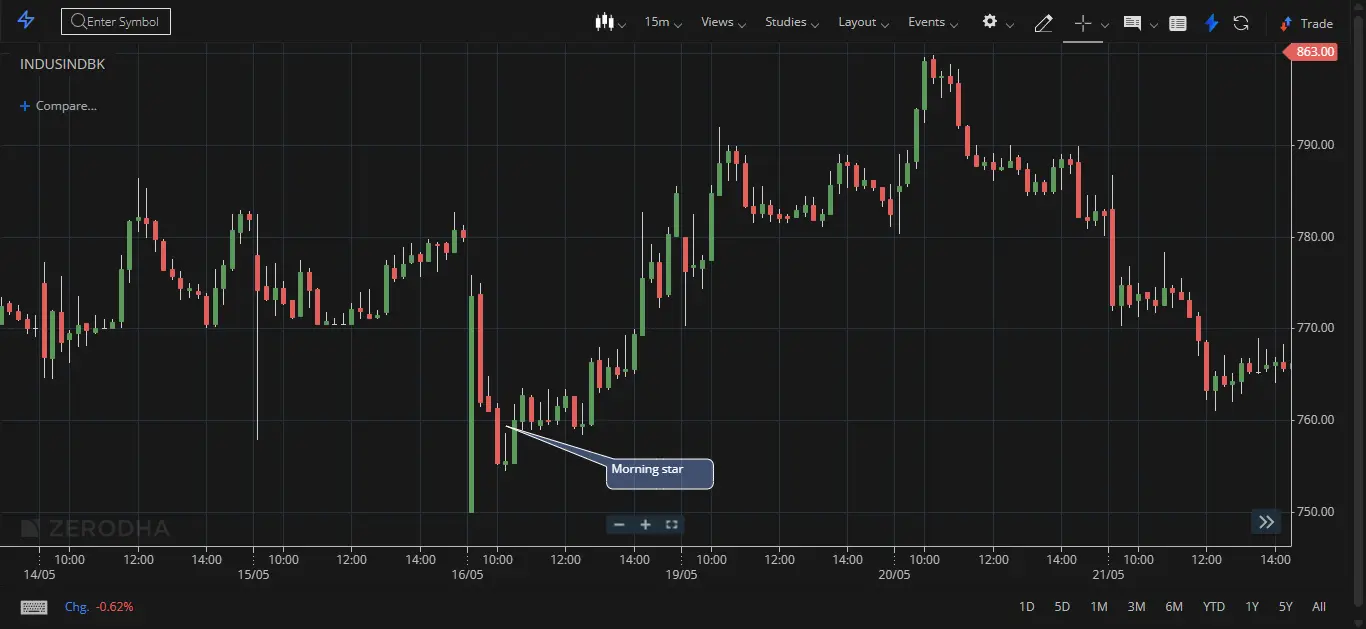

What Is the Morning Star Pattern?

The Morning Star is a bullish reversal pattern that typically forms after a downtrend. It indicates that selling pressure is fading, and buyers are beginning to take control. It’s called the "Morning Star" because it symbolizes the light after darkness — the start of a new bullish day.

How It Forms:

- First Candle: A large bearish candle, showing continued selling pressure.

- Second Candle: A small-bodied candle (can be bullish, bearish, or even a Doji), showing indecision and a potential pause in momentum.

- Third Candle: A strong bullish candle that closes above the midpoint of the first candle, confirming reversal.

Example of Morning Star pattern.

Trading Tips:

- Look for this pattern near a support level or after a strong downtrend.

- Confirmation with high volume or indicators like RSI divergence improves reliability.

- Place stop-loss just below the low of the middle candle.

What Is the Evening Star Pattern?

The Evening Star is the bearish counterpart of the Morning Star. It forms at the top of an uptrend and signals a potential bearish reversal. Just like the evening star signals the end of the day, this pattern hints at a possible end to bullish momentum.

How It Forms:

- First Candle: A large bullish candle, showing strong buying momentum.

- Second Candle: A small-bodied candle (or Doji), suggesting indecision or buyer exhaustion.

- Third Candle: A strong bearish candle that closes below the midpoint of the first candle.

Example of Evening Star pattern.

Trading Tips:

- Best used after a sustained uptrend or near resistance levels.

- Confirmation from the third candle with high volume strengthens the signal.

- Stop-loss can be placed above the high of the second candle.

Why These Patterns Matter

Morning and Evening Star patterns work because they reflect shifts in sentiment. The middle candle in both patterns represents a pause in momentum — buyers and sellers are uncertain. The third candle confirms the shift and tells us which side has taken over.

These patterns are easy to spot and can be powerful when used in the right context. They are especially reliable when paired with other tools like moving averages, Fibonacci levels, or volume analysis.

Tips for Beginners

- Always wait for confirmation before entering a trade based on Morning or Evening Star patterns.

- Use these patterns as part of a broader strategy — not as the only signal.

- Don’t trade blindly on appearance. Look at context: trend strength, support/resistance zones, and volume.

Summary

- Morning Star: Bullish reversal pattern after a downtrend.

- Evening Star: Bearish reversal pattern after an uptrend.

- Both patterns consist of three candles: large trend candle, small indecision candle, and a strong reversal candle.

- Context and confirmation are key to successful trading.

By mastering Morning and Evening Star patterns, traders can anticipate shifts in momentum and position themselves early in new trends. Practice spotting these patterns on charts, and use them wisely as part of your technical trading toolkit.